Choosing the right bank account for your small business can be extremely useful. It’s not just about where you stash your cash; it’s about finding a financial partner that understands your unique needs and helps you grow. From managing day-to-day transactions to securing loans for expansion, the right bank account can provide the tools and support you need to succeed.

But with so many options out there, how do you know which one’s best for you? Each bank offers different features, fees and benefits, making the decision even more complex. In this article, we’ll explore what you should look for in a small business bank account and how to make an informed choice that aligns with your business goals.

Benefits of Having a Small Business Bank Account

A small business bank account simplifies your money matters. It keeps your business and personal expenses separate. This makes it easier to manage your finances. Monitoring cash flow becomes straightforward. You can see exactly what’s coming in and going out. This clarity helps you plan your budgets effectively.

Transactions get organised. You’ll have a clear record of all purchases, sales, and expenses. This makes tracking and reporting much smoother. Come tax time, you won’t scramble for receipts. Everything is documented, reducing errors.

Access to efficient financial tools is another key benefit. Banks often offer tools that streamline bookkeeping. Digital banking solutions sometimes integrate with your accounting software. This reduces manual data entry and potential mistakes.

Professionalism and Credibility

Holding a business bank account boosts your company’s image. Clients see it as a sign of professionalism. Payments made out to a business name rather than a personal one inspire trust. It shows you’re serious about your venture. Customers might doubt your reliability if you lack this aspect. They expect professionalism in all dealings. A bank account helps you meet these expectations.

Credibility extends beyond clients. Suppliers and partners also take note. They might offer better terms when they see your financial stability. Having a dedicated business account reflects this stability. It’s an essential step in building strong business relationships.

Key Features to Consider When Choosing a Bank Account

Fees and Charges

Banks can charge diverse fees. You might find maintenance fees, transaction charges, and ATM withdrawal costs. When selecting a bank account, compare these fees. They might seem small initially but can add up quickly. Think about your business’s transaction volume and frequency. High transaction businesses, like retail stores, need to count every penny saved.

Interest Rates and Overdraft Facilities

Interest rates impact your savings growth. Some bank accounts offer interest on deposits. These accounts can help your money grow over time, even if only slightly. Compare interest rates offered by different banks.

Overdraft facilities can be a lifeline. Your business might experience fluctuating cash flow. Overdrafts can provide a safety net during tight periods. Check the terms and rates for overdrafts. Some banks offer better terms for small businesses. You don’t want unexpected costs to affect your business.

Access to Online Banking and Mobile Apps

In today’s digital age, online banking is crucial. Banks offer online banking platforms with various features. Mobile apps can make banking more convenient. You can pay bills, transfer funds, and monitor transactions anytime.

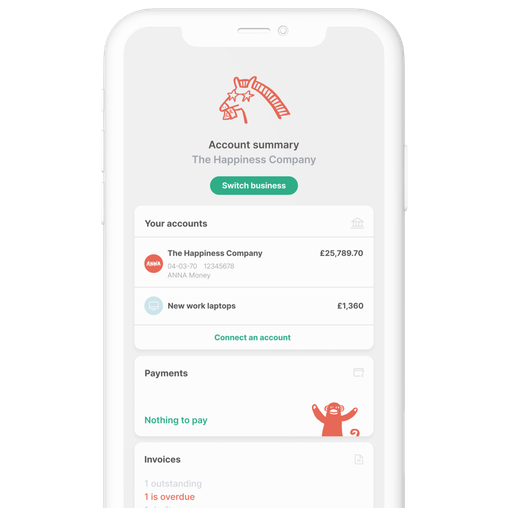

Evaluate the user interface of online and mobile platforms. Is it easy to figure out Does it offer all features your business needs Some banks even integrate with accounting tools, streamlining your financial management.

Choosing the right bank account involves many factors. From fees and rates to digital access, each feature can influence your business’s financial health. Make informed decisions that align with your business goals.

Comparing Top Bank Accounts for Small Businesses

Choosing the right bank account for your small business includes evaluating high street banks and online banks. High street banks such as HSBC and Barclays offer physical branches, which might appeal to those who prefer face-to-face interaction. You can visit these branches for personalised service, including cash deposits and withdrawal facilities. These banks also provide a sense of security and established reputation.

Online banks, like Tide and Starling, cater to the tech-savvy entrepreneur. They provide user-friendly mobile apps that let you manage your business finances on the go. These banks often have lower fees since they don’t maintain physical locations. However, online banks might have fewer face-to-face services, relying instead on digital customer service. Which type of bank suits your business needs?

Services and Features

Investigating the services and features a bank offers is crucial. High street banks might provide extensive business support, such as business advisers who guide your financial decisions. They often offer a wider range of products, including loans and credit cards tailored for businesses.

Online banks focus on integrating with modern tools. They provide features like instant transaction notifications and seamless integration with accounting software. Their emphasis is on efficiency and innovation. Are these features likely to benefit your business operations? Choosing the right bank involves balancing traditional trust with modern convenience. Your business objectives guide this essential decision.

How to Set Up Your Small Business Bank Account

Setting up a small business bank account involves gathering several documents. Banks often ask for proof of identity and business registration. You’ll need a passport or driver’s licence for identification. For business registration, companies house documentation usually suffices. Sole traders might provide a tax return.

Have you thought about proof of address? Many banks require a utility bill or lease agreement. Your address confirms your stable business location. They also ask for partnership agreements if your business isn’t a solo venture.

What about eligibility? Most UK banks accommodate small businesses. Your business must operate within the UK and comply with local regulations. If you have international dealings, banks may need extra proof. Ensuring compliance with anti-money laundering laws affects account approval too.

Steps to Application

Starting your application is straightforward when you know the steps. Initially, research and compare banks. Which one aligns best with your business goals? Traditional banks like HSBC might offer familiarity, while online options like Starling attract tech-savvy businesses.

Next, gather necessary documents. Got everything ready? Visit your chosen bank’s website. Most banks provide online applications. For those less comfortable, an in-person visit remains an option.

Filling out the application form requires attention to detail. Enter all required information accurately. Errors could delay approval. Banks often conduct identity checks and might ask further questions. Patience is key here.

After submission, banks review your application. This might take a few days. Approval grants access to your new account. You remember the joy of finding a service that fits perfectly; that’s what opening the right business account feels like. Now, you can start handling business transactions professionally.

In Closing

Choosing the right bank account for your small business is a pivotal step in ensuring smooth financial operations and projecting a professional image. By carefully evaluating key features like fees and online banking access, you can find an account that aligns with your business needs. The setup process may seem daunting but with the right documents and attention to detail, you’ll figure out it successfully. Ultimately, the right bank account not only simplifies your financial management but also supports your business’s growth and compliance with regulations. Take the time to research and make an informed decision—it’s worth the effort.